salt tax cap new york

Cuomos initial budget proposal in January and it comes at a time. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

Most New York Times Matt Dorfman Design Illustration Illustration Design Newspaper Design Health Magazine Layout

As part of the 2017 Tax Cuts and Jobs Act the amount of state and local taxes that could be deducted as an itemized deduction was limited to 10000.

. This provision is not available for publicly traded partnerships. By Louis Vlahos on April 7 2021. Before 2018 the SALT deduction was not limited meaning individuals could deduct 100 of the state and local taxes paid each year as an itemized deduction.

Unlike most states New Yorks fiscal year begins early on April 1 so it was motivated to act quickly. The SALT deduction tends to benefit states with many higher-earners and higher state taxes. 2 On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

By Nick Reisman New York State. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is known as SALT. Posted in New York State.

The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017 and without pointing fingers it seemed to many like it may have been taking a shot at blue states that tend. April 18 2022. The Pass-Through Entity tax allows an eligible entity to pay New York State tax.

The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. This consequential tax legislation available to. Seven statesCalifornia New York Texas New Jersey Maryland Illinois and Floridaclaimed more than half of the value of all SALT deductions nationwide in 2018.

Supreme Court on Monday rejected a bid by New York and three other states to overturn a 10000 cap on federal tax deductions for state and local taxes that Congress. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation.

The new tax which is included in Budget Bill A09009C is effective for tax years starting on or after January 1 2023. They wont really count when the 10000 cap on state and local tax deductions is repealed by Congress. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.

Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on a small scale. Yet while the newly adopted budget encourages high-income taxpayers to take advantage of these provisions they ought to come with a warning. The cap disproportionately affected those not subject to the alternative minimum tax AMT which denies certain tax breaks including the SALT deduction to subjected individuals.

New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property. New York estimates its taxpayers will end up paying 121 billion in extra federal taxes from 2018 to 2025 because of the SALT cap. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.

This new provision is effective for Tax Years 2018. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services Bulletin issued on August 25 2021 TSB-M-21 1C 1I. Previously there was no limit.

If this person also pays 40000 a year in real estate. Starting with the 2018 tax year the maximum SALT deduction available was 10000. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

New York Budget Deal Includes SALT Cap Workaround. The Supreme Court will not revive an attempt by New York and three other states to overturn the Trump-era 10000 cap on state and local tax deductions known as SALT. An owner of the electing entity is entitled to a credit against hisher City personal income tax equal to the owners direct share of City passthrough entity tax PTET paid.

PUBLISHED 549 PM ET Apr. State Local Tax April 22 2021 No. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

According to WalletHub when you measure taxes on individual. Primary Menu Sections Search. An eligible City partnership means any.

This was true prior to the SALT deduction cap and remained the case in 2018. The provision was part of Gov. New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround.

We take a closer look at what the reduced deduction has meant for residents of high-tax states like California New York and. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap.

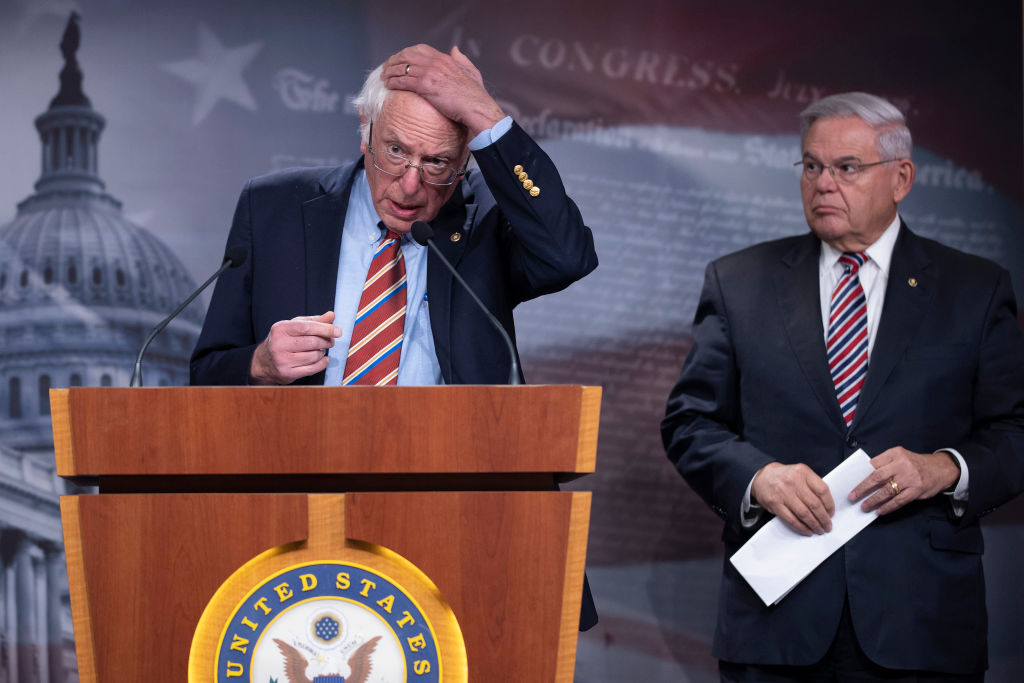

Bernie Sanders D-Vt is vowing to tweak the SALT provision perhaps by lowering the new cap to 40000 andor imposing an income limit of 400000 to benefit from it. For example a New York taxpayer with 1500000 in taxable income would pay 102750 in state income tax 685. New York is taking another run at repealing SALT cap.

Andrew Cuomos spin on the tax hikes in the state budget approved this month is this. SALT paid by the.

Lovebirds By Ballookey 2008 Adver Sponsored Aff Ballookey Lovebirds Lovebirds Art Wall Art Prints Framed Wall Art

Salt Deduction Cap Was Part Of A Package Wsj

Cuomo Privately Calls On Business Leaders To Stay In Ny Lobby On Salt

Donnie Edwards San Diego Chargers Edwards Los Angeles Chargers

Why This Tax Provision Puts Democrats In A Tough Place Time

Catering Specials 15 Off On 100 Or More 20 Off On 200 Or More Call To Order Now 512 345 7492 Order Online Pizzadaytx Pizza Day Organic Pizza Indian Pizza

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Solar Reserve Diagram Solar Power Plant Solar Generator Solar Power

House Democrats Propose Increasing Salt Cap To 72 500 Through 2031

Pin On John Wayne A K A The Duke

Nwt Michael Kors Kirby Lage Set Michael Kors Bag Bags Michael Kors

Marvin Dc Would Definitely Recommend This Place To Anyone Visiting Dc And Looking For Dinner And A Great Vibe Dc Travel Washington Dc Trip

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Hinkley Lighting 3487hb Argo 1 Light 14 Wide Build Com Hinkley Lighting Drum Pendant Lighting Lighting

Pagoda Shaoxing Huadiao Cooking Wines No Salt Chinese Cooking Wine Chinese Cooking Cooking Wine

Pagoda Shaoxing Huadiao Cooking Wines No Salt Chinese Cooking Wine Chinese Cooking Cooking Wine